The announcement by the Chancellor, in the March budget, of a mortgage guarantee scheme was the catalyst lenders needed to start focusing again on the low deposit lending market. Some of the biggest banks in the UK have signed up to the scheme and will from April offer 95% loan-to-value (LTV) mortgages. A number of lenders have already launched low deposit mortgages without the support of the government’s scheme and there is an expectation that more lenders will follow. Increased competition should provide borrowers with more choice, greater flexibility and hopefully (eventually) more competitive interest rates.

What is the Government’s mortgage guarantee scheme?

The mortgage guarantee scheme which is due to run from April 2021 to 31 December 2022 will see the government ‘guaranteeing’ 95% mortgages for buyers with 5% deposits. Under the terms of the scheme, the government will guarantee the portion of the mortgage over 80% (so, with a 95% mortgage, the remaining 15%).

Which lenders will offer mortgages under the scheme?

Lenders who offer regulated mortgages to home owners are eligible to participate in the scheme. Under the terms of the scheme, participating lenders will need to offer a five-year fixed-rate mortgage as part of their mortgage range. There is an anticipation that some of the high street banks will participate in the scheme.

Who is eligible to apply for the government-backed scheme?

The mortgage guarantee scheme is open to all home buyers, whether you’re a first-time buyer, 2nd stepper or downsizer. You’ll need to be buying a property to live in yourself – second homes and buy-to-let properties are not permitted. Both new-build and existing properties priced up to £600,000 are eligible. You’ll need to apply for a repayment (not interest-only) mortgage and pass standard lender affordability checks, including a loan-to-income (“LTI”) test and credit score assessment.

Why are some lenders choosing to offer 95% LTV mortgages outside the government back scheme?

Under the government scheme, lenders are required to offer 95% mortgages within set criteria. Where lenders prefer to set their own parameters, they must do so outside the scheme. A number of lenders (outside the scheme) have already launched their offering with their own criteria such as:

- 95% LTV mortgages only available to first time buyers

- Certain properties to be excluded such as new builds, flats

- Restricting LTI limits or the actual loan amount (thereby restricting the property value to below £600,000)

What are the risks of 95% LTV mortgages?

It’s important that you fully understand the potential risks of a high LTV mortgage:

- If your property drops in value the size of your mortgage could be higher than the value of your property; i.e. negative equity

- Generally the higher the LTV, the higher the rate of interest you’ll pay on your mortgage

- Currently 95% LTV lenders are only offering 5-year fixed interest rate products on a fully repayment basis, therefore your monthly payments are likely to be higher compared to interest only mortgage products

- Committing to a 5-year fixed initial term mortgage means that If your circumstances change during that time and you need to repay the mortgage there are likely to be significant early repayment charges (“ERCs”)

Example

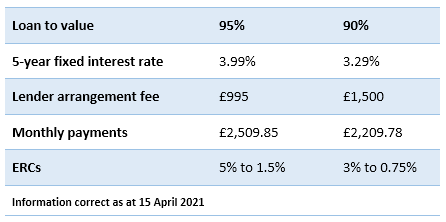

Detailed below are the 5-year fixed rate mortgage options for a home purchase of value £500,000 at 95% and 90% LTVs from the same lender:

This lender will also offer a 2-year fixed rate mortgage option for a 90% LTV mortgage at 2.99% and £1,500 lender arrangement fee.

What alternatives are there to the mortgage guarantee scheme?

There are some other options that can help you buy a home with a small deposit:

- The Help to Buy scheme offers between 5% and 20% equity loan (40% in London) from the government on new-build properties in England. From April, it will be limited to first-time buyers and regional price caps will limit the cost of homes sold under the scheme.

- The Shared Ownership scheme could offer you a route on to the ladder. These schemes involve purchasing a stake of as little as 25% of a property and paying ‘rent’ on the remainder. You will have the option to buy the remainder of the property at a later date.

- Some lenders currently offer a range of guarantor mortgages, which allow a parent or family member to help you buy a home. Guarantor mortgages usually involve the family member using their home or savings as collateral in case you default on your mortgage, but innovative products such as ‘joint borrower sole proprietor’ mortgages could be an alternative for some.

The emergence of low deposit mortgages is welcome relief for borrowers as their mortgage options will broaden. Over time as more lenders enter this market, competition may drive down the interest charged. For borrowers it’s vital that they understand all the options available and select the mortgage that meets their financial circumstances.

The above information is our understanding of the position as at 15th April 2021.

Get in touch

If you are currently looking for a residential mortgage, to refinance your existing mortgage, or would just like to discuss your personal position and current options, please contact the Kinnison team at:

e: [email protected]

t: +44 (0)20 3871 2823